What is a STAK?

On this page, you will find all the information about a STAK. What is a STAK? How does it work? What are the advantages and disadvantages of a STAK?

What is a STAK?

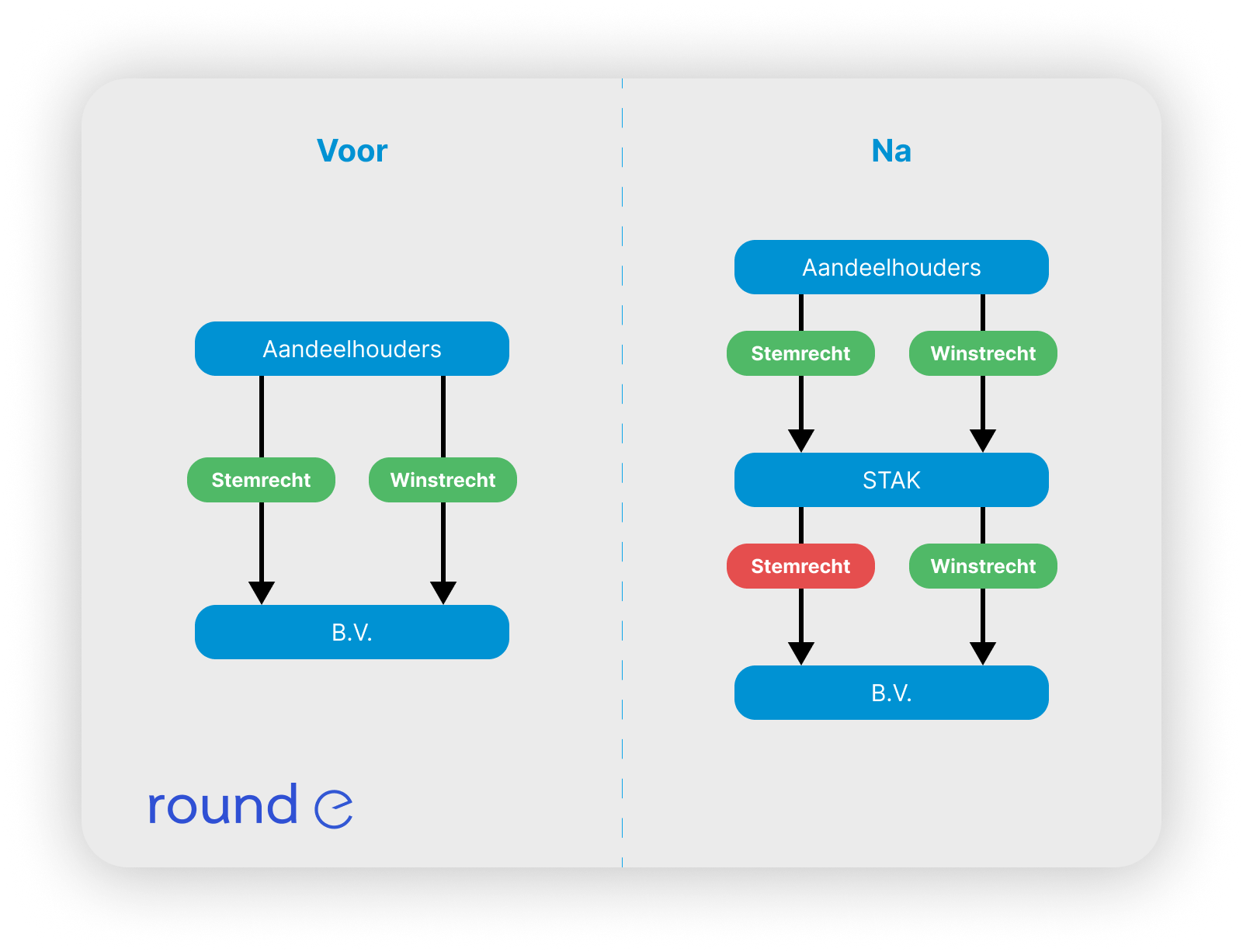

A STAK, or Stichting Administratiekantoor, is a legal entity often used in employee participation. The main purpose of a STAK is to separate the economic rights (such as dividends) from the legal rights (such as voting rights) of shares in a company. By creating this separation, a STAK ensures that employees can share in the profits of the company without directly influencing the strategic decisions of the company.

Below, we have shown an organizational chart of a STAK. As you can see, a STAK prevents employees from obtaining voting rights in the company.

Meaning of STAK

STAK stands for Stichting Administratiekantoor. This foundation holds the shares of a company and in return issues certificates to employees. This allows employees to share in the company's profits without gaining direct control.

When establishing a STAK, administrative conditions are created. These are the conditions that every certificate holder must adhere to. Contact us to see what the administrative conditions look like.

Why set up a STAK?

Setting up a STAK can be a smart move for your company for several reasons. Firstly, it is a great way to engage your employees more with the company without giving away direct control. This can significantly boost your team's motivation and loyalty. Additionally, it helps you retain control over your enterprise, which is particularly important as your company grows or if you have future plans you want to steer yourself. A STAK also offers a lot of flexibility: you can easily determine who gets which economic rights and to what extent. Finally, a STAK protects the continuity of your company because important decisions remain in the hands of a select group of people who know the company inside and out.

Advantages of a STAK

A STAK brings various benefits that can help your company grow and flourish. First of all, it creates a strong bond between your employees and the company. They literally feel like co-owners, which often leads to more commitment and better performance. This can boost the entire company culture. Another major plus is that a STAK does not negatively impact your company's liquidity. You do not need to pay out large sums of money for people to share in the success. Moreover, a STAK is a very flexible system. You can decide how many certificates you issue and to whom, allowing you to tailor it perfectly to the needs and merits of different employees. This makes it a powerful tool for attracting and retaining top talent.

Disadvantages of a STAK

Although a STAK has many advantages, there are also some challenges you need to consider. The biggest hurdle is often the complexity of the structure. Setting up and managing a STAK requires specific legal and tax knowledge. You will likely need the help of experts such as a notary, tax advisor, and lawyer. This brings us to the second disadvantage: the costs. Both setting up and maintaining a STAK can be quite expensive. You need to consider notary fees, advisory fees, and possibly additional administrative costs. Additionally, there are potential tax risks to be aware of. The valuation of the certificates and their tax treatment can be complex and require careful planning. Therefore, it is important to weigh these disadvantages against the benefits and carefully consider whether a STAK is the right choice for your specific situation.

Therefore, we often recommend using a SAR plan or a profit-sharing for your company. These schemes are cheaper to set up as they do not require a notary. Additionally, the costs of these schemes are deductible from corporate tax (VPB), which is a great advantage for companies.

Tax impact of STAK certificates

When it comes to the tax side of a STAK, it is crucial to pay close attention to the details. The tax authorities scrutinize such structures. One of the key points is the valuation of the certificates you issue. If an employee pays less than the market value, the difference can be seen as salary and thus be taxed. This can lead to unexpected tax assessments for both the company and the employee. Therefore, it is wise to have a professional valuation performed.

Another important aspect is whether the certificates fall into box 2 or box 3 for income tax. This depends on the percentage someone owns. At 5% or more, it falls into box 2, which has different tax implications than box 3. Therefore, it is important to carefully consider this when distributing the certificates.

Due to this complexity, it is always recommended to consult a tax advisor when setting up a STAK. This way, you avoid surprises later and ensure that your structure is set up as tax-efficiently as possible.

Why RoundE?

RoundE is your partner in employee participation plans. Instead of hiring expensive lawyers to set up your participation plan, we developed in-house software to streamline this process: saving you time and money

Quality

Our plans are checked by both tax and fiscal specialists. You also get a , so the contract fits your needs perfectly

Fair pricing

We besparen kosten door ons bedrijf online te runnen en het hele proces te automatiseren, waardoor we zeer concurrerende prijzen kunnen aanbieden.

Premium service

You can contact us at anytime and one of our legal experts will be ready to help you. With any purchase, you also get a free consult with one of our experts